Appraisal – A professional estimate and opinion of the value of real property based on the analytics of facts derived from Comparisons and market conditions.

Conditions – Loan approvals are conditional and subject To “conditions” being met before the loan is approved and ready to be closed. This conditional items need to be collected, corrected, or completed prior to loan closing.

Credit Rating – The rating of an individual as a credit risk, based on debt repayment history and current financial status.

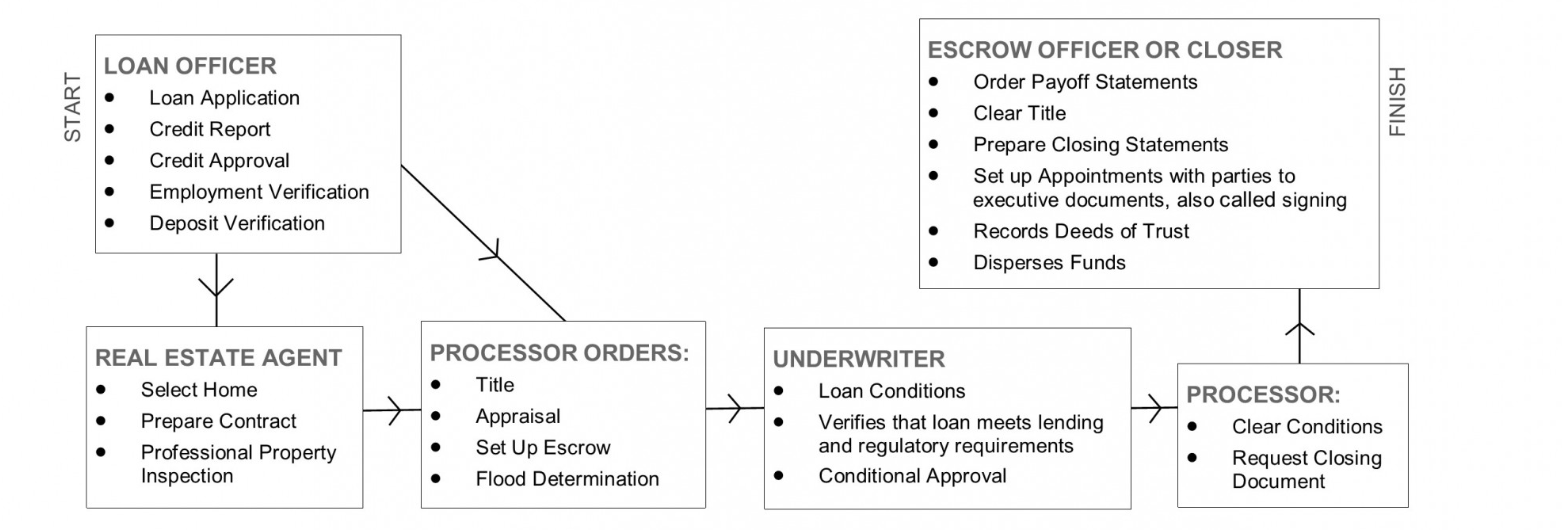

Home Buying Process

From Sale to Closing

We make sure our clients understand every step of the home buying process. Here is a look at how it all works.

Definitions

Escrow – A deposit of document, funds, and instructions with a neutral third party to carry out the provisions of an agreement of contract.

Title Insurance – An insurance policy written to protect a Property owner or lender against loss if title is defective.

Title Report – A preliminary report disclosing condition of title on real property issued prior to title insurance policy.

Underwriting – Review of the file to determine if Documentation and borrowed details meet the investor guideline requirements for the loan program.